2024 1040 Schedule Bing – To take advantage of homeowner tax deductions, you’ll need to itemize your deductions using Form 1040 Schedule A. Your decision to itemize will depend on whether your itemized deductions are . Depending on the type of activity, you’ll report your crypto gains and losses on Form 1040 Schedule D, or crypto income either on Form 1040 Schedule C for self-employment earnings or Form 1040 .

2024 1040 Schedule Bing

Source : twitter.comIRS Unveils Increased 2024 IRA Contribution Limits

Source : www.theentrustgroup.comIt’s not just Purdy. Several late picks and undrafted players make

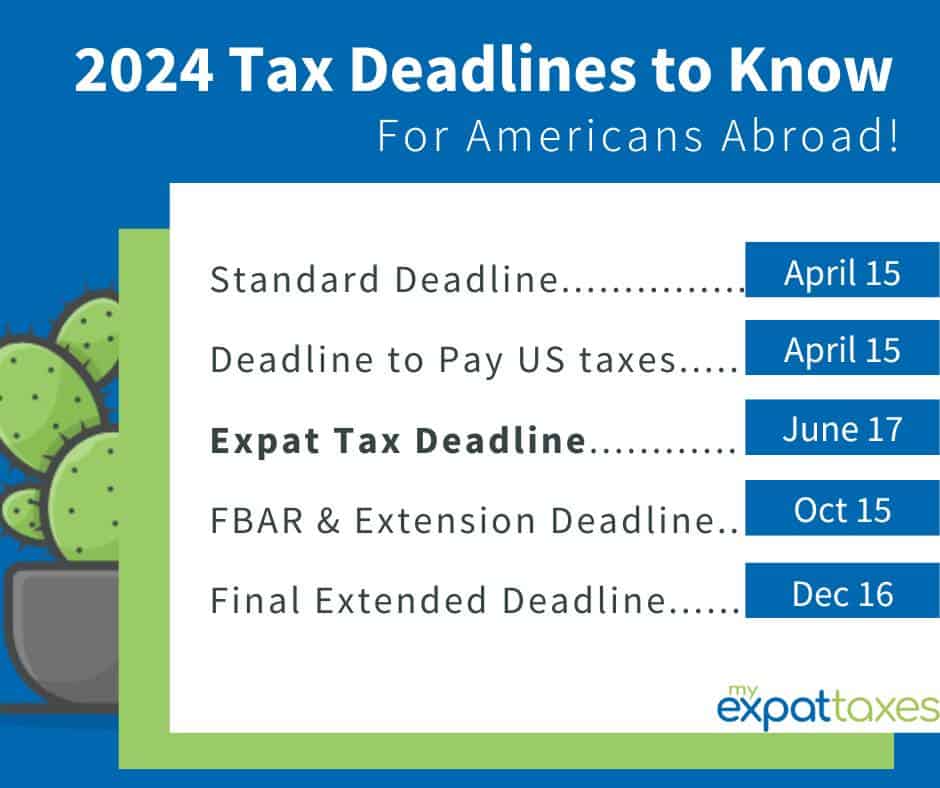

Source : www.binghamtonhomepage.com20 Things to Know About US Expat Taxes in 2024 MyExpatTaxes

Source : www.myexpattaxes.comFrom doinks to SpongeBob, technology to play a huge role in the

Source : www.binghamtonhomepage.com20 Things to Know About US Expat Taxes in 2024 MyExpatTaxes

Source : www.myexpattaxes.comMonth – Will’s Pub

Source : willspub.orgBlog | Green Trader Tax

Source : greentradertax.comICEA – International Children Education Association

Source : intlcea.orgNEW ARRIVALS — Featuring the limited edition Harvey Sweatshirt

Source : www.instagram.com2024 1040 Schedule Bing Bomgaars Supply on X: “Sign up for Bomgaars Loyalty Rewards and : You report commercial sales tax to the IRS on Schedule C, a supplemental sheet of the 1040 group of forms. Form 1040, Schedule C Use Schedule C to report all financial activity from your business. . You must file Form 1040 and Schedule A to itemize. Some itemized deductions are limited based on a taxpayer’s AGI. Others are restricted to a threshold, or percentage, of the filer’s AGI. .

]]>